- 24 Aug 2022 05:42 PM

- New

Revenue of states may grow 7-9% this fiscal: Report

New Delhi: Overall revenue of top 17 states in the country, which account for 85-90% of aggregate gross state domestic product (GSDP), is likely to grow at 7-9% this fiscal, Crisil Ratings said on Wednesday.

Read More

- 23 Aug 2022 06:20 PM

- New

Govt to investigate fraudulent misuse of PAN for GST registration

Recent reports in a section of the media have highlighted a case of Sh. Girish Yadav, a resident of Khagaria, Bihar having received a letter from the jurisdictional GST authorities for recovery of GST amounting to Rs. 37.5 lakh alongwith applicable interest and penalty.

Read More

- 22 Aug 2022 06:21 PM

- New

CGST Bhiwandi arrests 2 persons for bogus invoices of Rs. 55 crore

CGST Bhiwandi Commissionerate arrests two persons for availing and passing on fake ITC on bogus invoices of Rs. 55 crore

Read More

- 22 Aug 2022 06:26 PM

CGST Navi Mumbai arrests one for availing & passing on fake ITC

Source: https://taxguru.in/goods-and-service-tax/cgst-navi-mumbai-arrests-availing-passing-fake-itc.html

CGST Navi Mumbai arrests one person for availing and passing on fake ITC on bogus invoices

Read More

- 22 Aug 2022 06:33 PM

Representation on RCM on Residential Property, GTA Declaration & GST Appeal

Maharashtra Tax Practitioners’ Association has made a representation on Confusion related to Levy of GST under RCM on Residential Property, Rejection of Appeal for non-submission of Certified copy of order from Authorities and Issues related to GTA Time Limit Of 16.08.2022 For Submission Of Annexure V.

Read More

- 19 Aug 2022 06:07 PM

Tax officials will not summon CEOs, CMDs ‘routinely’

NEW DELHI : The Central Board of Indirect Taxes and Customs (CBIC) has told field officers to be judicious while exercising their power of issuing summons to senior officials of companies such as chief executive officers, chairman and managing directors and chief financial officers (CFOs), an official order issued late on Wednesday said.

Read More

- 19 Aug 2022 06:10 PM

Probe wings of NAA, CCI to be merged

Source: https://www.livemint.com/companies/news/probe-wings-of-naa-cci-to-be-merged-11660839960507.html

NEW DELHI : The Union government plans to merge the investigation wings of the National Anti-profiteering Authority (NAA) and Competition Commission of India (CCI) to deal with goods and services tax-related offences.

Read More

- 18 Aug 2022 05:39 PM

5 new Functionality for Tax Payers in GST Portal wef 16.08.2022

Source: https://taxguru.in/goods-and-service-tax/functionality-tax-payers-gst-portal-wef-16-08-2022.html

GSTNB enables Functionality for Tax Payers in GST Portal wef 16.08.2022 related to CORE Amendment Link For Taxpayers who fail To Update Bank account, Changes in HSN length validation in Form GSTR-1, HSN based validation in Form GSTR-9, Generation of GSTR-11 based on GSTR-1 and GSTR- 5 for UIN holders and Updation of Statistics on GST Portal.

Read More

- 17 Aug 2022 05:46 PM

Kerala launches app to curb GST evasion by offering attractive prizes to users

THIRUVANANTHAPURAM : In a first in India, the Kerala government has launched an app that aims to curb Goods and Service Tax (GST) evasion. The app, ‘Lucky Bill App’, was launched by chief minister Pinarayi Vijayan on Tuesday.

Read More

- 17 Aug 2022 05:53 PM

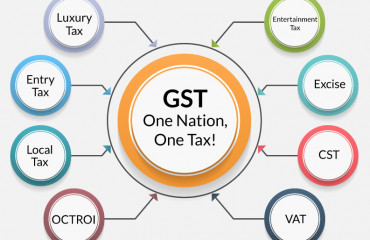

Fixing these design flaws can help states collect more GST

At a meeting with the state chief ministers, Prime Minister Narendra Modi has asked the state governments to work to improve their collections of the Goods and Services Tax (GST).

Read More