- 17 Feb 2025 06:22 PM

- New

KSCAA Representation on Streamlining GST Registration Process

Karnataka State Chartered Accountants Association (KSCAA) has presented a detailed representation to the CBIC Chairman, highlighting challenges faced in the GST registration process and proposing solutions to enhance efficiency and user-friendliness. Key issues include inconsistent documentation requirements between central and state authorities, logistical hurdles in biometric verification, inaccuracies in geocoding addresses, and lack of transparency in centrally allocated registrations. KSCAA suggests implementing uniform Standard Operating Procedures (SOPs), enabling biometric verification at local GST Seva Kendras, and integrating reliable mapping tools. They advocate for technology-driven solutions like online verification, SMS alerts for spot visits, and fast-tracking registration approvals within a stipulated time frame. KSCAA emphasizes the need for a case-by-case evaluation of applications, especially for home-based businesses, and urges clarity on landlord-tenant registration conflicts. Additionally, they recommend establishing redressal mechanisms for frivolous rejections and enhancing portal transparency to provide real-time updates and officer details. These measures aim to simplify the GST registration process, reduce delays, and support genuine taxpayers in compliance efforts.

Read More

- 17 Feb 2025 06:18 PM

- New

KSCAA Calls for Professional Tax Portal Upgrades to Resolve OTP & Payment Issues

Karnataka State Chartered Accountants Association (KSCAA), established in 1957, represents Chartered Accountants and advocates for effective resolutions to professional challenges. In a letter to the Karnataka Chief Minister, the KSCAA highlights critical issues with the Professional Tax portal under the Karnataka Tax on Professions, Trades, Callings, and Employment Act, 1976. Key concerns include delays in GST-related enrollment registration, inefficiencies in two-factor authentication causing OTP delivery failures, and inadequate password reset options. The Association also raises issues like incomplete registration categories for non-GST entities, limited payment options, frequent technical glitches during payments, and recurring login errors stating “User does not exist.” These challenges disrupt taxpayers’ compliance efforts. The KSCAA recommends streamlining registration, enhancing OTP delivery reliability, expanding payment options, fixing technical issues, and improving customer support to address these concerns effectively. The letter emphasizes the need for an efficient tax administration system to foster ease of doing business in Karnataka.

Read More

- 14 Feb 2025 06:15 PM

- New

Mint Quick Edit | Finally, a tax law we may be able to grasp

India’s move to simplify its income tax law promises us relief from something even experts found hard to comprehend. And it’s unjust for anybody to be hauled up for breaking rules they can’t understand.

Read More

- 14 Feb 2025 06:12 PM

After a tax cut and a rate cut, it's time now for a GST cut

After the Union government reduced the tax burden on individuals and the central bank followed with an interest rate cut, it's over to the states now.

Read More

- 14 Feb 2025 06:35 PM

India’s Income Tax Bill sets the stage for significant reforms

The Income Tax Act of 1961 has undergone innumerable amendments since its inception (4,000, as stated by the finance minister in Parliament). Historically, successive governments have used tax as an instrument to incentivize specific industries, promote investments in certain regions, or to encourage foreign exchange earnings. As a result, numerous provisions were added over the years to provide sectoral, regional or specific activity-related benefits. Additionally, various explanations, provisos and exceptions were introduced to clarify or nullify the impact of judicial pronouncements.

Read More

- 13 Feb 2025 06:19 PM

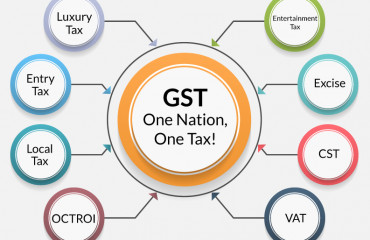

GST Simplification Efforts and MSME Compliance Relief

Source: https://taxguru.in/goods-and-service-tax/gst-simplification-efforts-msme-compliance-relief.html

The Indian government refutes claims that GST complexities hinder business operations, stating that the tax structure follows GST Council recommendations, comprising four main slabs—5%, 12%, 18%, and 28%—with additional special rates for specific goods. Measures have been taken to counter GST fraud, including special drives in 2023 and 2024, leading to the detection of fake registrations and tax evasion cases. To support MSMEs, exemptions from GST registration apply to small businesses based on turnover, and simplified compliance schemes, such as the Composition Scheme and QRMP, have been introduced. Additionally, retrospective amendments and penalty waivers aim to ease compliance burdens.

Read More

- 13 Feb 2025 05:56 PM

Fantasy sports revenue may drop 10% in FY25 amid tax policy shifts: Report

The looming possibility of a retrospective tax order, which could pose an existential threat to companies like Dream11, MPL, My11Circle, and BalleBaazi

Read More

- 13 Feb 2025 06:03 PM

Government’s Approach to Future GST Reforms in India

Source: https://taxguru.in/goods-and-service-tax/governments-approach-future-gst-reforms-india.html

In response to an unstarred question in Rajya Sabha on February 11, 2025, the Ministry of Finance addressed the government’s approach to potential GST reforms. The government stated that any changes to the GST framework are made based on the recommendations of the GST Council, a constitutional body under Article 279A. It acknowledged industry concerns and emphasized its commitment to reducing compliance burdens, simplifying tax procedures, and enhancing the ease of doing business. Several recent measures have been implemented following GST Council recommendations, including a retrospective amendment to Section 16(4) of the CGST Act, 2017, extending the time limit for availing input tax credit for past financial years. Additionally, Section 128A has been introduced to waive interest and penalties for certain tax demand notices if dues are cleared by March 31, 2025. Further, amendments to Sections 107 and 112 have reduced pre-deposit requirements for GST appeals. For small businesses, the mandatory registration requirement for intra-state supply through e-commerce operators has been conditionally waived from October 1, 2023, allowing composition taxpayers to make intra-state supplies under specified conditions. The government continues to assess stakeholder suggestions to improve GST implementation.

Read More

- 13 Feb 2025 06:10 PM

GST on Educational Services and Exemptions

Source: https://taxguru.in/goods-and-service-tax/gst-educational-services-exemptions.html

Goods and Services Tax (GST) applies differently across educational services. Commercial coaching and training services are taxable at 18% under Notification No. 8/2017, while services provided by educational institutions to students, faculty, and staff, as well as printed books under HSN Code 4901, are exempt from GST. The GST revenue collected from taxable education services such as commercial training amounted to ₹2,859.49 crore in 2021-22, ₹4,342.28 crore in 2022-23, and ₹4,793.24 crore in 2023-24. Various exemptions exist to support educational institutions, such as transportation, catering (including mid-day meals), security, cleaning, admission, and examination-related services for schools up to the higher secondary level. The GST Council, a constitutional body, prescribes rates and exemptions to ensure affordability in the sector. These measures aim to maintain accessibility and affordability in education services.

Read More

- 13 Feb 2025 05:50 PM

Bogus companies, fake invoices: ₹1,196 crore GST fraud unearthed by DGGI Pune Zonal Unit; check details

The Pune Zonal Unit of DGGI has uncovered a GST evasion scheme involving ₹1,196 crore, arresting one individual. A director of a private firm based in Muzaffarnagar as been identified as the mastermind behind the operation.

Read More