- 12 May 2022 09:18 PM

- New

Haryana Excise Policy for The Year 2022-23

Source: https://taxguru.in/goods-and-service-tax/haryana-excise-policy-year-2022-23.html

The Excise Policies of the State have successfully achieved and strengthened the long term objectives of breaking the cartels, broad-basing the trade by facilitating the entry of new players of even modest means, simplifying/unifying the structure of wholesale supply of liquor by giving wholesale licenses to retail licensees, establishing a transparent system of allotment of retail outlets, complete check on manufacturing/sale of spurious liquor, thwarting all attempts of evasion of excise levies, plugging the leakage/pilferage, optimization of revenue, creating ambience for legitimate and responsible drinking and providing good quality liquor at reasonable price to those who drink.

Read More

- 11 May 2022 07:03 PM

- New

Cos resist GST recovery tactics in court amid record tax collections

The trend indicates the escalating tussle between tax authorities and businesses when the government’s revenue needs and business’ liquidity requirements are high

Read More

- 11 May 2022 07:10 PM

- New

GST Council Newsletter for the month of April, 2022

Source: https://taxguru.in/goods-and-service-tax/gst-council-newsletter-month-april-2022.html

Gross GST collection in April, 2022 is all time high, Rs. 25,000 crore more than the next highest collection of Rs.1,42,095 crore, just last month.

Read More

- 10 May 2022 07:14 PM

No more GST compensation needed, Centre to tell states

NEW DELHI : The central government is likely to tell states at the next meeting of the Goods and Services Tax (GST) Council that the buoyant GST revenue trend shows that states no longer need funds from the Centre as compensation for the 2017 indirect tax reform.

Read More

- 10 May 2022 07:19 PM

Cryptocurrency conundrum! GST Council mulls imposing heavy tax: Report

In what could further spoil the mood of crypto investors in the country, the goods and services tax (GST) Council is likely to consider imposing 28 per cent tax on cryptocurrencies. The proposal is likely to be tabled in the next GST Council meeting.

Read More

- 06 May 2022 06:20 PM

E-way bill generation dips in April; may hit May’s GST collection

Source: https://www.livemint.com/news/india/eway-bill-generation-eases-a-notch-in-april-11651759680854.html

NEW DELHI : Generation of e-way bills, which are needed to ship goods within and across states, eased a notch in April, suggesting that Goods and Services Tax (GST) collections this month could be lower than the previous month’s record high.

Read More

- 06 May 2022 06:29 PM

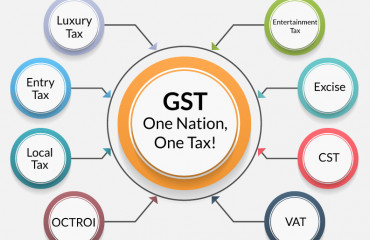

GST 2.0: Ideas to improve indirect taxation

While the implementation of GST in India has been commendable, the time is ripe for the government to take note of some of the challenges which the business community at large has been facing, from blockage of working capital to duplicity of assessment proceedings.

India is set to complete five years since the implementation of the Goods and Service Tax Law. The journey of the first half decade of this landmark reform has undoubtedly been a rollercoaster ride with a mixed bag of hits and misses.

- 06 May 2022 06:33 PM

GST Auditor Arrested – Fake ITC Racket Busted by State GST Officers

Enforcement Authorities South Zone, CTD have raided the residential and business premises of a GST Auditor at Bangalore and Davanagere based on field intelligence, data analytics and Police FIR and busted a fake ITC case.

Read More

- 06 May 2022 06:36 PM

One arrested in Nashik in for availing fraudulent ITC of Rs. 27.88 Crores

M/s Hira Steel, Nashik is engaged in the business of trading of steel and scraps. The officers of the Nasik Preventive (Hqrs.), an anti evasion wing of Central Goods and Services Tax, Nashik has inspected/visited the premises of M/s Hira Steel, PAP-54, Near Siemens, MIDC, Ambad, Nashik as per the provision laid down in Section 67(2) of the CGST Act, 2017.

Read More

- 05 May 2022 05:36 PM

Wellness centres part of hotels and resorts liable to pay GST: AAAR

The Appellate Authority for Advance Ruling (AAAR) has said that health therapy services offered by wellness centres that are part of a hotel or resort cannot be classified as ‘health-care service’ and are therefore taxable.

Read More