- 22 Jul 2022 02:00 PM

- New

SC lists plea challenging GST on disability devices for hearing in September

A writ petition challenging the levy of GST on equipments for differently-abled persons was mentioned before the Supreme Court today.

Read More

- 22 Jul 2022 05:53 PM

- New

SC gives relief on tax credits to businesses

Source: https://www.livemint.com/news/india/sc-gives-relief-on-tax-credits-to-businesses-11658490487520.html

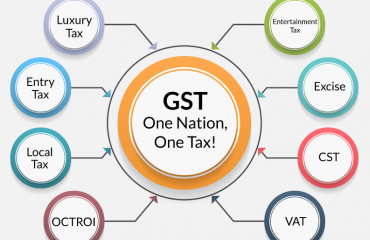

New Delhi: The Supreme Court on Friday asked the Goods and Services Tax Network (GSTN) portal to be kept open for two months from 1 September for businesses to claim tax credits arising from the transition to the new indirect tax regime in July 2017.

Read More

- 21 Jul 2022 11:48 AM

- New

No GST on funeral services: Govt

Source: https://www.livemint.com/news/india/no-gst-on-funeral-services-govt-11658332916590.html

The government on Wednesday said there is no Goods and Services Tax (GST) on funeral, burial, crematorium or mortuary services.

Read More

- 21 Jul 2022 11:56 AM

Why is Paneer butter masala trending on Twitter? Full story

Amid the row over 5% GST on packaged daily use food items like , Paneer Butter Masala started trending on Twitter. Congress leader Shashi Tharoor today tweeted sharing the meme on GST, “I don't know who comes up with these brilliant WhatsAPP forwards but this one skewers the folly of the GST as few jokes have!"

Read More

- 21 Jul 2022 12:09 PM

Details of GST Compensation released to States/UTs for a period of 5 years

GST compensation to States for loss of revenue arising on account of implementation of GST for a period of five years

Read More

- 21 Jul 2022 12:26 PM

New Table 3.1.1 in GSTR-3B for reporting supplies u/s 9(5)

Source: https://taxguru.in/goods-and-service-tax/table-3-1-1-gstr-3b-reporting-supplies-u-s-95.html

According to section 9(5) of CGST Act, 2017, Electronic Commerce Operator (ECO) is required to pay tax on supply of certain services notified by the government such as Passenger Transport Service, Accommodation services, Housekeeping Services & Restaurant Services, if such services are supplied through ECO. For reporting of such supplies a new Table 3.1.1 is being added in GSTR-3B as per Notification No. 14/2022 – Central Taxdated 05th July, 2022 wherein both ECOs and registered persons can report their supplies made under section 9(5) respectively.

Read More

- 21 Jul 2022 01:36 PM

Claim of 18% GST on Crematorium Services is Misleading

Source: https://taxguru.in/goods-and-service-tax/claim-18-gst-crematorium-services.html

Claim: There will be 18% GST on Crematorium Services

Read More

- 21 Jul 2022 02:18 PM

AIIMS Delhi raises private ward room rent after 5% GST levy

New Delhi: The All India Institute of Medical Sciences (AIIMS- Delhi) has raised charges of its private ward rooms following the recent decision by the GST Council to levy a 5% tax on hospital room rent exceeding ₹5,000 per day.

Read More

- 21 Jul 2022 02:27 PM

Break BJP's prison, bring people's govt in 2024: Mamata Banerjee at TMC rally

Addressing the Shaheed Diwas (Martyr's Day) rally in Kolkata, West Bengal Chief Minister and Trinamool Congress (TMC) supremo Mamata Banerjee on Thursday attacked the Bharatiya Janata Party (BJP), saying the party is trying to break all state governments.

Read More

- 20 Jul 2022 02:35 PM

No GST on items sold by Kudumbashree or small stores, says Kerala government

Amid growing protest over the imposition of Goods and Services Tax (GST) on essential commodities, Kerala government said on 19 July that it does not intend to tax items sold by entities like Kudumbashree, or small stores in 1 or 2 kg packets.

Read More