- 05 Jan 2024 05:42 PM

- New

Budget 2024: From GST reduction to expansion of Section 80 C, here's what the insurance sector is expecting

Ahead of the Lok Sabha elections, all eyes will be on the interim budget presented by Finance Minister Nirmala Sitharaman on February 1, 2024. Experts are of mixed opinion about whether the budget will be more inclined to populist measures or fiscal prudence.

Read More

- 05 Jan 2024 05:26 PM

- New

Budget 2024: Real estate sector bats for GST revision, tax sops to boost affordable housing — here is a wishlist

As India eagerly awaits Finance Minister Nirmala Sitharaman's sixth Union Budget, to be presented in Parliament on February 1, 2024, the nation’s real estate sector, particularly the affordable housing segment, is poised in anticipation. To realise the government’s vision of ‘Housing for All,’ experts and industry leaders have shared their insights, proposing vital measures to boost the affordable housing landscape. The proposals include revisiting GST rates, tax deductions, land allocation, and fund boost. The upcoming budget is seen as an opportunity to fortify the real estate industry’s pivotal role in India’s economic development.

Read More

- 05 Jan 2024 05:31 PM

- New

Vodafone Idea to contest ₹10.76 crore penalty order under CGST Act, cites 'wrong transition of CENVAT credit'

Vodafone Idea Limited on 4 January announced that it will take appropriate legal action for rectification and reversal of an order it received under the Central Goods and Services Tax Act, 2017, entailing a penalty of ₹10.76 crore.

Read More

- 05 Jan 2024 05:39 PM

Data recap: GST, car sales, shipping cost

Source: https://www.livemint.com/economy/data-recap-gst-car-sales-shipping-cost-11704367376974.html

Every Friday, Plain Facts publishes a compilation of data-based insights, complete with easy-to-read charts, to help you delve deeper into the stories reported by Mint in the week gone by. The Centre’s goods and services tax (GST) collections grew 10.3% year-on-year to ₹1.65 trillion in December. Meanwhile, the recent attacks on vessels in the Red Sea have led to a surge in shipping costs.

Read More

- 05 Jan 2024 05:50 PM

SC issues Notice to to Finance Ministry on GST Return Revision Option on Portal

Pradeep Kanthed Vs. Union of India and Ors (Supreme Court of India)

Introduction: The Supreme Court of India, in the case of Pradeep Kanthed v. Union of India and Ors [Writ Petition (Civil) No. 1006/2023], issued a notice to the Finance Ministry on January 2, 2023. The notice addresses concerns raised by the petitioner regarding the absence of an option for revised returns on the GST portal, creating issues for GST-registered persons and dealers.

- 05 Jan 2024 05:46 PM

Hat-trick on cards? Dividends from CPSEs may cross ₹50,000 crore this year too: Report

Dividends from central public sector enterprises (CPSEs) are likely to cross ₹50,000 crore during the current fiscal for the third year in a row. It has already exceeded the Budget Estimate (BE) during the current fiscal year, reported Business Line.

Read More

- 05 Jan 2024 05:54 PM

Live Webinar on Input Tax Credit covering recent Circular and Judgments

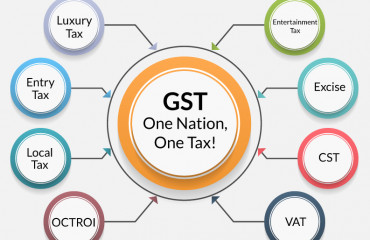

Who are saying that for more than 5 years happened the Goods and Service Tax Act, 2017 introduced. It was new tomorrow, new today and also will be new in the future. GST and its amendments are continuous for us.

Read More

- 03 Jan 2024 05:35 PM

LIC share price rises over 1% even as the insurer gets penalty notice worth ₹116 crore

Life Insurance Corporation of India (LIC) share price: LIC share price rose 1.8% on Wednesday's trading session despite the insurer's announcement on Tuesday that tax authorities had issued a demand notice for approximately ₹116 crore due to nonpayment of Goods and Services Tax (GST) for the 2017–18 tax year. LIC share price today opened at ₹838.80 apiece on BSE. LIC share price touched an intraday high of ₹853 and an intraday low of ₹837.45. According to Ruchit Jain, Lead Research Analyst at 5paisa, LIC share price has been forming higher top higher bottom. The 20 DEMA support is placed around ₹800, followed by a swing low at 746.

Read More

- 02 Jan 2024 05:21 PM

Indian stock market: 6 things that changed for market overnight - Gift Nifty, rise in oil prices to steady dollar

Indian stock market: The domestic equities are likely to open on a positive note Tuesday following mixed cues from global peers.

The Asian markets traded mixed while the US stock futures were flat after returning from a holiday. Investors await key economic data from the Asian region, while keeping an eye on crude oil prices amid tensions in the Red Sea.

- 02 Jan 2024 05:42 PM

HUL hit with ₹447.5 crore GST demands and penalties

Leading FMCG maker Hindustan Unilever Ltd on Monday said it has received Goods and Services Tax demands and penalties totalling ₹447.5 crore from the authorities.

In a regulatory filing, HUL -- which owns brands such as Lux, Lifebuoy, Surf Excel, Rin, Pond's and Dove -- said these "orders are currently appealable" and it will make an assessment.