- 25 Jan 2024 06:15 PM

- New

Budget 2024 Expectations: From CTT to GST issue, here are long-pending demands of commodity market participants

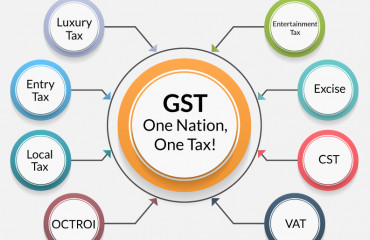

Budget 2024 Expectations: The commodity markets have emerged as a robust exchange to manage the risk associated with the trading of commodities in India. However, the growth has slowed down since the Commodity Transaction Tax (CTT) was introduced in 2013. There is still a tremendous amount of unfinished agenda for the commodity markets. The interim budget 2024 could be a good beginning to address these long-pending issues.

Read More

- 25 Jan 2024 05:47 PM

- New

Budget 2024 Expectations LIVE Updates: ITR, GST, Online gaming player, healthcare and other sectors voice their wishlist

Budget 2024 Expectations Live Updates: With the forthcoming Budget 2024 in India generating heightened anticipation, a wide spectrum of sectors looks forward to the announcements and fiscal policies from FM Nirmala Sitharaman that will influence their unique domains. Ranging from agriculture, infrastructure, and healthcare to education, finance, and manufacturing, each sector harbors specific expectations regarding allocations and reforms. United in their fiscal agenda, these sectors express their collective aspirations for a budget that propels growth, fosters innovation, and enhances societal well-being.

Read More

- 25 Jan 2024 05:41 PM

- New

Cut deficit to 5.4% in FY25: Ind body to govt

Source: https://www.livemint.com/economy/cut-deficit-to-5-4-in-fy25-ind-body-to-govt-11706119216028.html

New Delhi: The government should stick to its fiscal deficit target of 5.9% in the current financial year and aim to narrow this to around 5.4% in FY25, a goal that would require boosting revenue receipts and rationalizing spending, industry lobby Confederation of Indian Industry (CII) said.

Read More

- 24 Jan 2024 05:40 PM

Budget 2024 expectations: EV industry pins hopes on subsidy extension and GST reforms

As the Indian government gears up for the Interim Budget announcement in February, leaders in the electric vehicle (EV) industry are optimistic about crucial reforms that could further help the sector's growth. The statements from prominent figures in the industry shed light on their expectations and aspirations for a budget that addresses key issues and supports the EV landscape.

Read More

- 24 Jan 2024 05:45 PM

Budget 2024 Expectations: Streamlining TCS to GST credit —here's what travel & tourism sector expects this year

Finance Minister Nirmala Sitharaman will unveil the Interim Budget for the financial year 2024-2025 (FY25) on February 1, 2024, which is likely to keep the focus on fiscal consolidation and nominal economic growth projection and may not involve any major policy changes.

Read More

- 24 Jan 2024 05:47 PM

‘New GST rate has sent sector back by months’

Source: https://www.livemint.com/news/new-gst-rate-has-sent-sector-back-by-months-11706021190789.html

Mumbai: The gaming industry had an eventful 2023. First, the ministry of electronics and information technology (MeitY) emerged as its nodal ministry, offering a clear, designated channel for industry interaction. Then came a big setback with the sharp increase in GST rate. In an exclusive interview, Bhavin Pandya, co-founder and co-CEO of Games24x7, discussed the government’s apprehensions, the industry’s quest for regulations, repercussions of the tax rise, investor outlook, and the pathway for future growth amid perception hurdles. Edited excerpts:

Read More

- 24 Jan 2024 05:54 PM

Budget 2024: Apparel exporters seek tax incentives to boost manufacturing

New Delhi: Apparel exporters body AEPC on Wednesday sought tax incentives such as uniformity in GST and enhanced interest subsidies to boost domestic manufacturing and India's outbound shipments.

Read More

- 24 Jan 2024 05:51 PM

Interim Budget 2024: Space industry seeks liberal FDI policy, PLI scheme

India's nascent space sector has sought a liberal FDI policy on par with the defence industry and production-linked incentive in the interim Budget that the government will present next week.

Read More

- 23 Jan 2024 05:56 PM

Budget 2024 expectations: GJEPC urges for duty cuts on gold and polished diamonds

Ahead of the Union Budget, the Gem and Jewellery Export Promotion Council (GJEPC) have urged the government to reduce import duty on gold and cut and polished diamonds to help the sector stay competitive globally.

Read More

- 23 Jan 2024 06:00 PM

Budget 2024 expectations: Perks for first-time homebuyers, tax sops, industry status top real estate players' wish list

Budget 2024 expectations: With Budget 2024-25 only days away, top real estate players lay stress on increased tax slabs and revised affordability caps in their wishlist. They also advocated for incentives, anticipating a budget that addresses critical challenges, stimulates demand, and aligns with the government's vision of sustainable growth. The sectoral leaders called for the expansion of the SWAMIH (Special Window for Affordable and Mid-Income Housing) stress fund and the creation of a second tranche aimed at completing stalled projects and ensuring liquidity. Additionally, they called for tax reliefs for first-time homebuyers and the reintroduction of GST with an input tax credit on under-construction properties to stimulate demand.

Read More